CONTENTS

‣ Pursuing the American Dream as a

BIPOC Homeowner

‣ Saving Homes, Stabilizing Communities

‣ Finding Confidence and Stability

through Housing

‣ Finding Hope through Shared Equity

Homeownership

‣ Artist, Advocate, Agent of Community

Impact in Bellows Falls

A NOTE FROM OUR DIRECTORS

Homes, Community, Health

35 years ago, our first initiative took place led by a group of Brattleboro volunteers. It resulted in the preservation and rehabilitation of several historic buildings that were in awful condition, but were home to many families. This effort prevented these families from losing their homes, improved their living conditions, preserved the historic character of a highly visible neighborhood and sparked the beginning of the Housing Trust. These early themes in our work — preserving and strengthening neighborhoods while stabilizing people’s lives by improving living conditions and increasing housing opportunities are the very through lines that are still recognizable today.

In this report, there are inspiring stories of impact over the years, community volunteers who have been engaged with the Housing Trust since it’s early years, and Vermonters whose lives have improved as a result of our work in the last year. Two of these stories, one featuring Sara, a renter in Brattleboro and the other featuring Shauna, a new homeowner in Windsor both demonstrate how critical an affordable home can be in preventing families from facing the challenging life that comes with having no a home at all.

Vermont is one of the states in the nation with the highest, per capita, number of people without a home, second only to California. And many who are fortunate enough to have a home live in unfavorable conditions, pay too much of their income for housing costs and struggle with day to day expenses. These are the challenges we address every day and we are so proud of the tremendous progress we made the 2022.

- In January, we broke ground on the Bellows Falls Garage with the removal of the severely blighted existing building making space for 27 new, beautiful and affordable homes. As this report goes to print, families are moving in to these new homes!

- We also advanced two new construction projects through the design and permitting process, which will result in 25 new homes in Windsor Village and 25 new homes in Putney Village.

- 7 of our earliest buildings, a combined 26 units in Brattleboro and Windsor underwent extensive rehab to tighten efficiencies, accessibility, and upgrade systems

- 9 new shared equity homes came into our program, homes that will remain affordable to future generations of homeowners.

- We launched a new program, SASH For All, a pilot program modeled after our traditional SASH program and provides health and wellness focused support to families where they live.

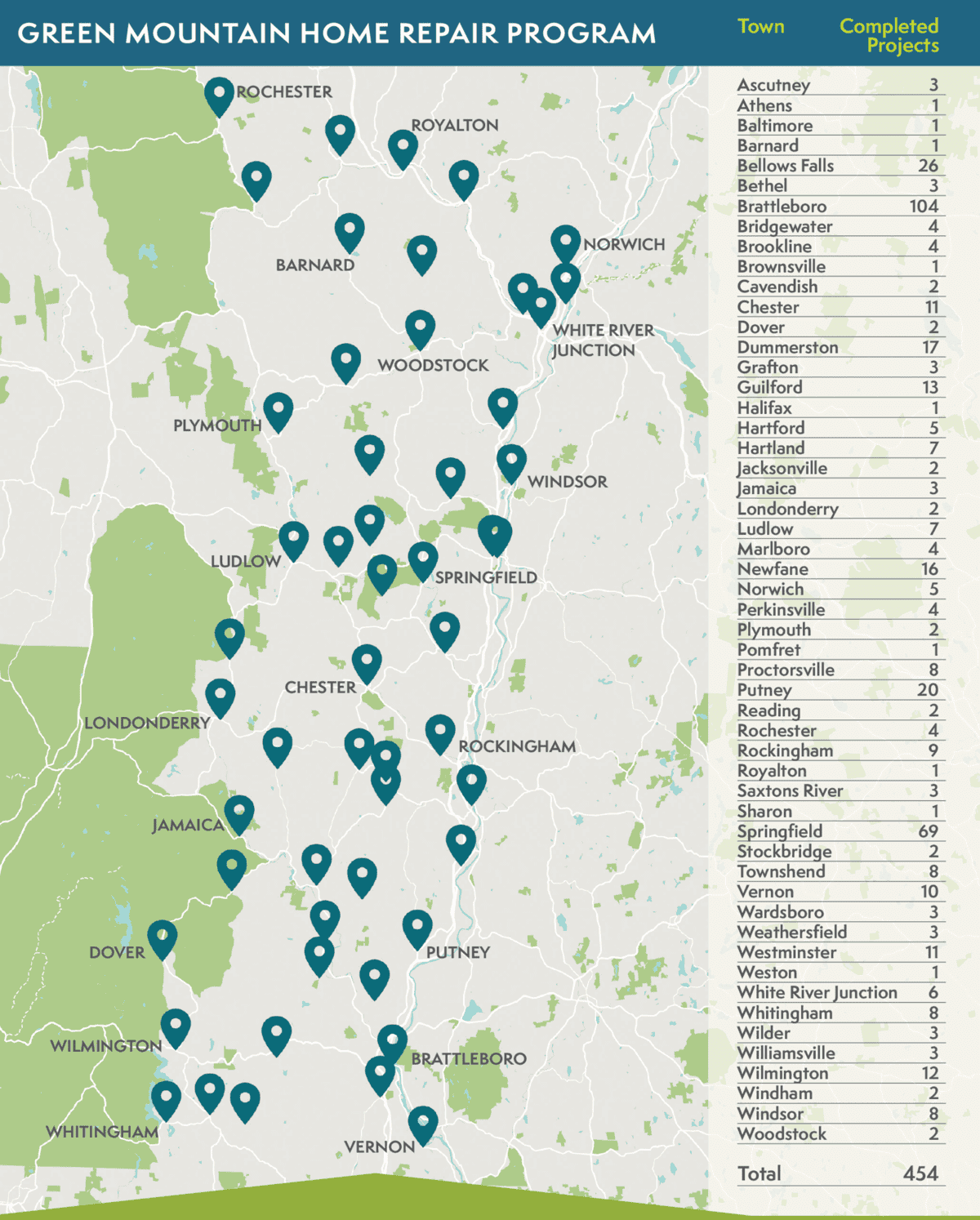

What started as an effort to rehab a few homes slated for demolition has grown into a multi-faceted, highly impactful organization that has helped thousands of Vermonters over the years. The enclosed map is a great visual illustration of this impact.

Of course, none of these accomplishments happened without the help of hundreds of people — policy makers, legislators, funders, vendors, donors and members of the community. This is what makes our mission so rewarding. Together we are strengthening our communities and helping everyday Vermonters by providing the most basic human need — a place to call home. Thank you for supporting this work.

Executive Director

Board President

Ana Mejia spent much of her youth moving from one place to the next. The daughter of immigrants from El Salvador, she recalls her parents’ constant struggle to find stable housing in Southern California. “Every time the rent would increase, we would up and move again.” That transiency continued as Ana pursued college, then grad school, then study abroad interspersed with short-term internships. When she moved to Vermont in 2018 to accept a year-long internship with AmeriCorps, she was determined to settle down.

“I knew I wanted to own a home and set roots down,” says Ana. Her dream became a reality in September of 2020 when she purchased her single-family home in Hartland.

Even before she became a homeowner, Ana found connection and engagement with her new, chosen community. She volunteered with Cover Home Repair, an Upper Valley non-profit that provides weatherization and home repair for low income households. “I like to volunteer and get involved – that connection is important to me,” she says. It didn’t take long for Ana to feel engrained in the community. She started researching the process of buying a home.

When Ana reached out to the Housing Trust to enroll in their homebuying education course, she already knew what grant programs she wanted to pursue. Throughout the long and difficult process, Ana was grateful for the support she received from her WWHT counselor at every step. “Kayla was a wonderful resource,” she says. “I was 27 at the time, and I was buying as a single individual, so I didn’t have a partner to talk about the things I was encountering. Having someone I could turn to for advice and support was invaluable.”

Ana’s experience as a BIPOC homebuyer, and her passion for societal engagement, has become the impetus for a BIPOC-centered Homebuyer Affinity Group, developed in partnership with WWHT. The support group is part of a larger Healing Series offered through the Root Center for Social Justice in Brattleboro. Ana is instrumental in the program’s design, and is serving as its facilitator.

“It’s no secret that homeownership is, has been, historically, a tool for building generational wealth,” says Ana. “We know that BIPOC households face substantial barriers toward those goals. And while racial discrimination practices are illegal, that doesn’t stop it from happening, and it doesn’t undo the years of living under racist structures. So we have some catching up to do.”

Ana herself says she encountered racialized experiences during her homebuying journey. “It was a constant battle. And I always had to have my guard up and advocate for myself. As a person of color, you ask yourself, is this what other people deal with too? So that’s what the homebuying group is going to be, where people can share their experiences, and find advice on how to navigate these challenges.”

Ana is excited about working with WWHT, and the potential of this new venture. “So far I’ve had a great experience with the Housing Trust,” she says. “I’ve really enjoyed seeing them lean into the experience I bring. They’re not being prescriptive on how to run this space. You don’t find that very often.”

“Being a homebuyer can be, should be, a very empowering experience,” says Ana. “Even if I don’t always feel a complete sense of belonging, or being welcome or inclusive in other places in the community, at least I have my home. I can find solace there. It’s a start.”

Green Mountain Home Repair Program:

Saving Homes, Stabilizing Communities

Dave Grobe recalls a particular home repair site visit where the homeowner was moving buckets around his living room when it rained. Dave is one of two Home Repair Specialists in the Green Mountain Home Repair program whose job it is to help homeowners understand, manage, and access funding to repair their homes. On paper, his job is about construction and home repair. In reality, it is much deeper than that.

“I feel like we are in a battleground way bigger than our program,” says Jerry Freeman, the program’s second Home Repair Specialist. “We’re in an environment these days where it seems like the cost of goods and services, and everything around us has gone up at a rate more than personal income has gone up. For homeowners who are on the edge of being able to keep up with their home and all the expenses in their life, sometimes it feels like a losing battle. I like to think we’re that little bit of difference that keeps them on the best path. So I feel like it’s a very important thing we do.”

WWHT’s home repair program has been in operation since 2001, offering low-cost and deferred loans, as well as project oversight for income-eligible homeowners. In 2017 the program boosted its outreach efforts when it was re-branded as the Green Mountain Home Repair program. In all, the program has completed over 600 home repair projects across the agency’s service map (including projects in neighboring regions). Jerry covers projects in Windham County and Dave is assigned to Windsor County. Between them, they have seen every imaginable home repair scenario.

“Oftentimes there are more challenges with a job than have been communicated,” says Dave. “The truth is, people are not going to leave their home no matter how bad the conditions are. They are going to move that bucket around to catch whatever part of the roof that’s leaking that day. I find it tough not to do what we can.”

Tara Brown is the Lending Manager. She describes the process of onboarding a new project. “Jerry or Dave will meet with the homeowner to discuss the repairs the homeowner wants, but they also do a full site visit. There are requirements of the program, things we have to do to ensure we are addressing all major health issues.”

Those program requirements address things like lead paint, asbestos or bringing electrical systems up to code. Sometimes, they add to the scope of work and the required budget, and that’s when things get tough. Dave says they always try to approach a job with an open mind, but sometimes the challenges are insurmountable. “It can be extremely frustrating at times. If they can’t meet housing quality standards for some reason, then we have to walk away from the project. That’s hard. But I think we honestly do everything we can.”

Oftentimes there are more challenges with a job than have been communicated.

—Dave Grobe, Green Mountain Home Repair

Well cap, before

Well cap repair, after

The fact that we had been able to point out that deficiency, potentially saved them from harm.

The GMHR team worked with the homeowners for close to three years. “The process involved a tremendous amount of work addressing environmental review and historic elements, and three different funding sources,” says Jerry. “ I don’t think we’ve ever done anything like that before. Looking back, it was a fifty, sixty thousand dollar project — and that was before COVID pricing. There were a lot of elements, and it all came together pretty darn well.”

In order to qualify for the program, an applicant’s household income needs to be no more than 80 percent of their county’s median household income. That number varies according to county and the number of people in the household. Applications range from senior citizens on fixed income, to young families, to people needing to address accessibility. “We have a lot of people who come back into the program over the years, which is always the best compliment you can get,” says Tara.

Finding good contractors is a big part of Dave and Jerry’s job, and key to the success of the program. “If we have a good contractor, we have to do everything we can to make the process as straightforward as possible for them,” says Jerry. “Those folks are a real asset to our program.”

“The good contractors are gold for us,” adds Dave.

The GMHR team understands that home repair is just part of the big picture for many of the homeowners they meet. “There are cases where I end up being friends with the owners we work with,” says Jerry. “Some of these people have so many issues they are trying to work through; sometimes the conversation can’t help but segue into various other things going on. Some people just want someone to talk to.”

In those cases, the team agrees it’s helpful when a case manager is working with the family. “That way, you know that they are being connected to other resources beyond what we can do in the Repair program,” says Tara.

Jerry recalls one of the program’s success stories that he is particularly proud of. “There was a case up in Whitingham where I did an inspection, and the scope of work was replacing an old and faulty boiler. We always check for smoke and carbon monoxide detectors, and I noted a couple were missing. So the homeowner got right on them, before the boiler was replaced. Long story short, there was a malfunction with the boiler, and carbon monoxide was released into the home. The detector picked up on that, sounded and got them out of the house. The fact that we had been able to point out that deficiency, potentially saved them from harm. Anytime a project ends well and it’s a happy outcome, that’s a good one for me.”

Dave says his favorite success stories all share a common theme. “Those people are all still in their homes. I consider that a measurement of success.

Sarah’s Story:

Finding Confidence and Stability through Housing

When Sarah and her young daughter moved into their own apartment in the Daly Shoe building after living in the Groundworks shelter for a year, Sarah gave herself permission to finally pursue her dream job in the funeral industry.

“It’s something I’ve wanted to do since I was 8 years old when I attended my grandfather’s funeral,” says Sarah. “The funeral director was so passionate, I felt like he was best friends with my grandfather. It meant a lot to me how kind he was, and how he just instantly felt like family. I knew right then I want to do that for people.”

But that dream felt completely out of reach for Sarah for a very long time. A learning disability coupled with financial hardships pushed her far off the path. She struggled with life’s basic needs. Then, through the support she received at the shelter, she found work at a hotel, and eventually found the apartment with WWHT.

Then she saw an ad on Indeed for funeral personnel. Something about being in a stable home gave her the confidence to apply. “I had no experience, I really just pleaded my case — said this was something I wanted to do. Once I reached out, and I did get the job, I found how rewarding it was.”

Sarah has lived in her apartment for almost three years now. The building is a restored historic manufacturing structure that contains 29 affordable apartment units. Sarah loves the high ceilings, the big windows, and the airiness of her apartment. Plus, pets are allowed. Her family now includes a 9-month old German Shepherd-Laborador mix named Bella. “That’s been a new, joyful experience,” she says.

Another benefit of living in the building is having the Housing Trust offices right downstairs. “Whenever I have a question I can always just go down to the office and ask somebody, and they are always willing to help. I really appreciate that.”

Sarah and her daughter enjoy attending the weekly art socials put on by the SASH program on Wednesday afternoons. SASH is a free health and wellness program available to residents of WWHT properties. Sarah is not enrolled in the SASH program yet, but is considering it when she has more time. “I can’t add too much to a working Mom’s plate right now,” she says.

As landlords, Sarah gives the Housing Trust high marks. “They are not intrusive — they really give you your space to do your own thing. They are really flexible with rent payments, and that’s been extremely helpful. Sometimes it’s hard to make rent right on the first, and they understand that. They work with me, and I’m really appreciative of that.”

She says affordable housing is like a stepping stone for people who are trying as hard as they can. “It gives them — me included — a chance to see what it’s like without having to struggle. It really takes that homeless fear out of your head as a tenant, and it helps you to grow as a person. The Housing Trust’s mission and work in this area is extremely important and helpful for so many people in this community.”

As for Sarah’s job at the crematorium, child care issues have required her to pause her dream once again and return to the job at the hotel. However, she is content in the knowledge that her job is waiting for her when she is ready to return. “As soon as my daughter is old enough I have a position I can go back to. It’s so rewarding — so sad — but so rewarding to be there in such a crazy time in people’s lives.”

That day, I picked them up from school and surprised them with a welcome home sign held by their favorite Yoda.

2022 was a banner year for WWHT’s Shared Equity program. Historically, the Housing Trust sees one or two transactions a year. Last year, there were nine. “It was just a huge year for us,” says Marion Major, who handles marketing and outreach for WWHT. She cites the pandemic-fueled surge in Vermont’s housing prices as a factor. “We’ve experienced so much upward pressure in the housing market — wealthy families and entities have been able to invest in properties and push pricing up at every juncture. This includes the rental market, rents are much, much higher, and that’s kept people from stepping into homeownership. Being able to make it possible for someone who is locally employed to own a home in the community – that’s a really big deal.”

Although there were a few resales, the majority of the last year’s transactions were buyer-driven, meaning new homes were brought into the program. There are now 140 permanently affordable homes in WWHT’s program. “That’s 140 households that have gained access to homeownership that would not otherwise have had that ability,” says Chuck.

There are parameters to the program that limit the pool of eligible real estate. The sale price of the home must fall within a specific range, under $250,000. There are geographic constraints as well, with most eligible towns located along the I91 corridor.

Shaunna feels lucky to have found the home she did. “We live in Windsor, and it’s one of those eligible towns, so it was perfect. I love that my kids were able to stay in the only town they really know. My oldest son started school in Windsor when he was in kindergarten. We moved here right when my middle son turned a year old and my youngest son was born and raised in here. This community is like their big family, so it was really nice that we were able to stay.”

She says her experience working with Steve at the Housing Trust took a lot of the stress out of the homebuying process. “Buying a home is super overwhelming, and of course you’ve got your realtor, but it’s good to have somebody else to talk to. Everyone was super friendly, super easy to work with. I really can’t say enough good things about them.”

Chuck Collins is proud of the Shared Equity program’s longevity, its success, and its promise for the future. “There are not a lot of Community Land Trusts across the United States,” he says. “It’s very cool to note that Vermont really holds a lot of leadership in this area.” He recalls his learning from New Communities — one of the earliest Community Land Trusts — early in his career. “WWHT is a great example of what we hoped would happen,” he says.

“We want the Housing Trust to be around for a long time, because part of its role is to maintain that pool for future generations, and keep adding to it. If you add ten units a year, you start to create a pool of housing that is going to stay anchored and rooted in the community. And it’s going to be available to moderate-income homebuyers — the Missing Middle — in perpetuity. It evens the playing field a little.”

For Shaunna, becoming a homeowner has changed the trajectory of her life, and she can now envision a future filled with possibility. But there was one last hurdle for Shaunna before her closing date.

“Our family was homeless for a month between the eviction and when we closed on the house. We lived in a borrowed RV at Running Bear Campground. It was super stressful for me, but the kids loved their end-of-summer camping trip. They knew we were buying a house but I didn’t tell them when we were closing. That day, I picked them up from school and surprised them with a welcome home sign held by their favorite Yoda. They did indeed finally have a home!”

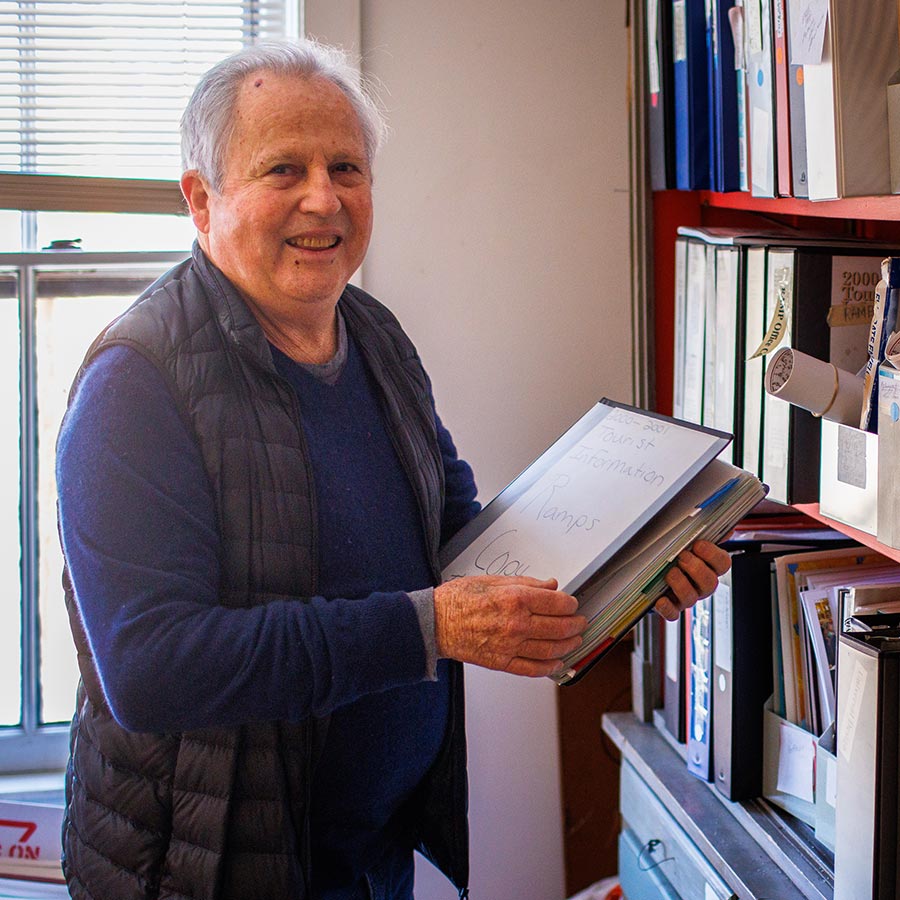

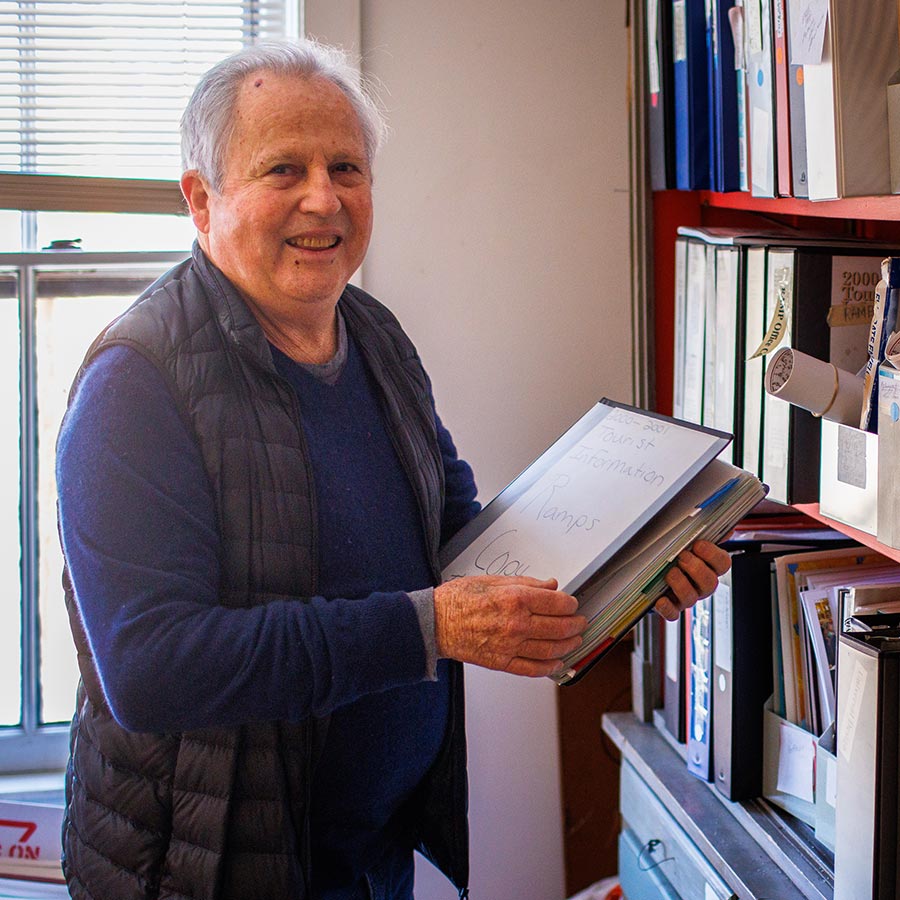

ROBERT MCBRIDE

Artist, Advocate, Agent of Community Impact in Bellows Falls

As a young artist living in New York City, Robert McBride never imagined the life that would unfold for him following a spontaneous trip to Vermont in the early 1980s. He was invited to join a group of friends to attend a community dinner party at the Andrews Inn in Bellows Falls.

“I was in my early 20s, I had never been to Vermont in my life,” recalls Robert. “So, I went to this dinner party with friends and all these people from the community. The next day I was walking around town, and all the storefronts were open, and I walked by this little house on Canal Street that had a For Sale sign on it.” By the end of that week, Robert and three of his friends had bought the house. And so began a deep-rooted love of place that would last a lifetime for Robert.

“Everything in my life has happened that way — total serendipity — nothing has been planned, it just happens.”

It took a few years, but finally in 1995 Robert — now the sole owner of the house — took another trip to Vermont, and this time he stayed. “I didn’t really realize I was moving there,” he jokes. Robert describes the state of Bellows Falls at that time as dismal.

“Pretty much 70% of the downtown was vacant at that point — boarded up and vacant. I thought, if I’m going to be here, maybe I can use my background in the arts to create some activity.” And so he did. He started hosting events and initiating public art projects. He founded the Rockingham Arts and Museum Project (RAMP) to further integrate the arts into the community. He brought the Bread and Puppet Theater to town for a memorable performance in the Square. He went to public meetings across the State and represented Bellows Falls with pride and enthusiasm. He became an avid supporter of any project or initiative designed to revitalize Bellows Falls.

When Rockingham Area Community Land Trust (now WWHT) wanted to redevelop the Exner Block into affordable housing, they asked Robert to share his vision for the building. “I said it would be great if we could give preference to artists. They agreed, and asked me to work with them as a community sponsor. I would attend the weekly meetings with the architects and construction team, give input on the building, and then as it got closer to opening, brought continued attention to the building so that when it opened, we had leases signed and applications in. I was kind of a local presence to support the project.”

Since the Exner Block redevelopment, Robert has remained deeply involved in a number of housing projects — currently with WWHT’s Bellows Falls Garage project — always lending support and enthusiasm; always a model for making the community “housing ready.” In another serendipitous turn, Robert owns two houses adjacent to the Garage property. He was thrilled when he heard the Housing Trust was looking at the garage.

“It was like my prayers had been answered,” says Robert. “I reached out and said if there is any way that I can be supportive to the project let me know.”

Robert used his status as a trusted neighbor, activist and property owner to rally support for the two-year project, tirelessly attending every meeting and promoting the economic benefit for the downtown. He even housed the construction crew in one of his houses. “I couldn’t be more pleased with Windham & Windsor Housing Trust to have the vision to move forward with that building, and be persistent because that’s a building that no one was ever going to touch and work with.”

Robert credits the excellent guidance of Elizabeth Bridgewater for seeing the Garage project through. “And clear-headedness,” he adds. “Elizabeth was great about hosting public meetings about the building and its progress, and she can handle the diversity of things that happen in a crowd. She did a spectacular job of listening to people’s concerns, reacting to them, making some changes, and moving forward.”

Robert has remained involved in the project through every phase, and he is looking forward to the changes in the neighborhood. “I’m thinking that it will liven up that part of downtown a little more. And then to have the activity of residents coming and going, walking by my house or to the park, or up to the downtown, it will be great. You know, wherever people live, there’s natural, good policing, in the best sense.”

At 71, Robert is ready to focus more on his arts organization, and he is happy to see more people getting involved. “It’s nice to see that evolution. People either get Bellows Falls right away or they don’t — I always say, you don’t choose Bellows Falls, Bellows Falls chooses you.”

And Bellows Falls clearly chose Robert McBride. “It’s really been an interesting ride. I had no idea I would be spending the rest of my life here. You know, at 45 I was living in New York, and then suddenly here I am! I love being in Vermont because of the access you have. You can roll up your sleeves and do something — make an impact. I think it’s a very vibrant community now, and I’m just very, very thrilled to live in this community.”

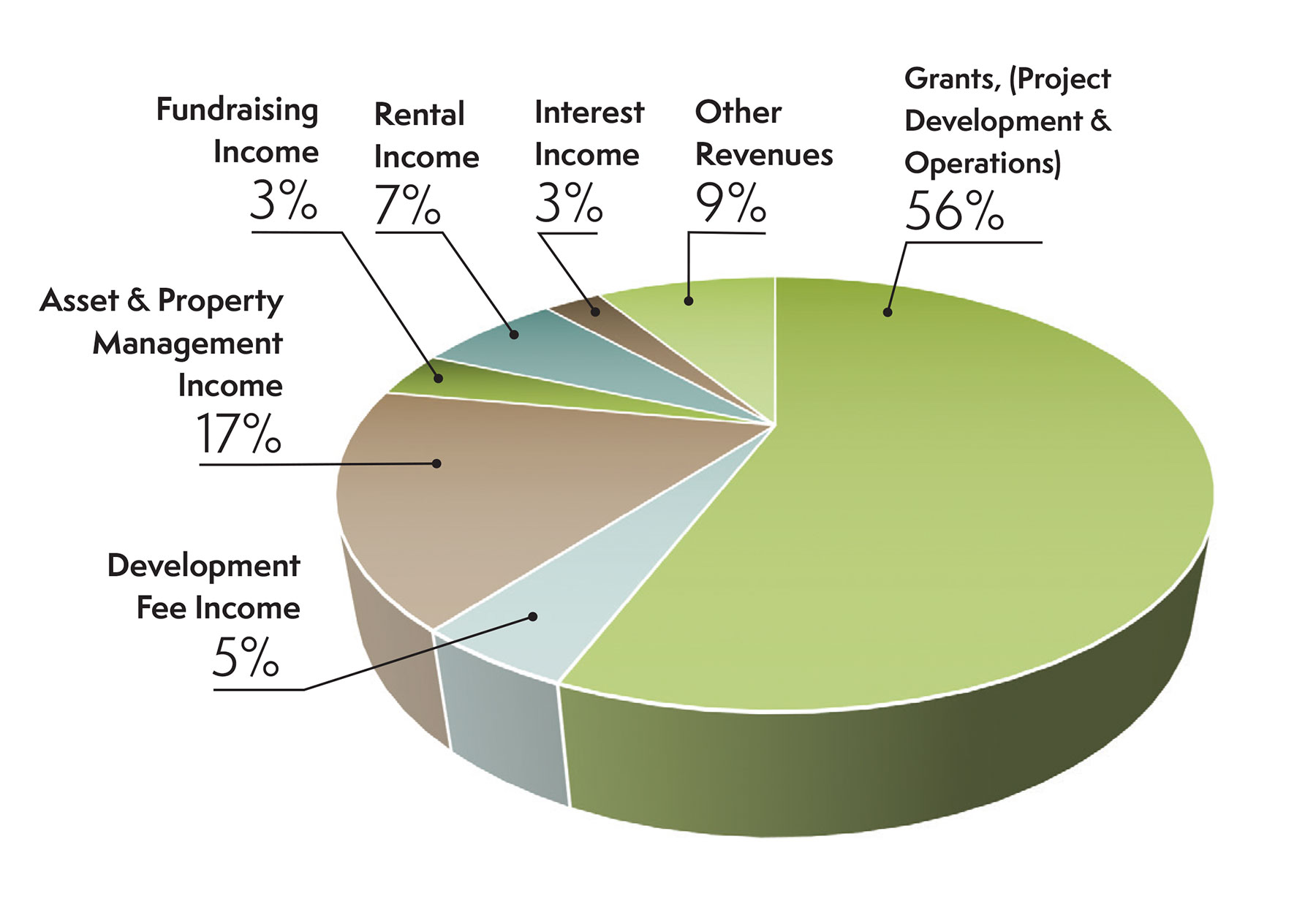

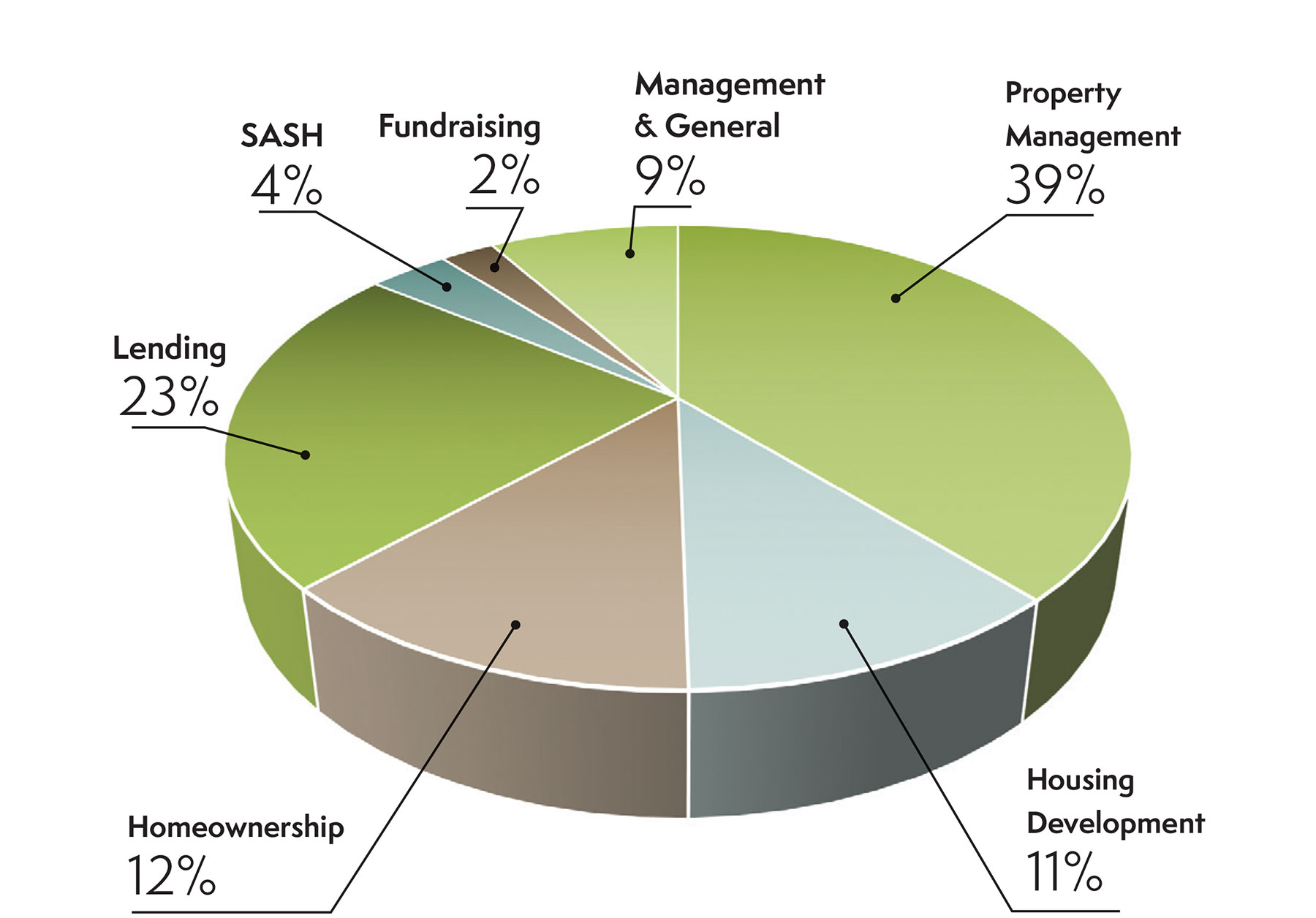

Financials

Statement of Activities

For more information, click here to read the complete financial report for the year 2022.

Our Donors

Your gift matters in so many ways.

It means local families get the best start to homeownership. It means we can support a neighbor through retaining their home despite the economic hardship brought on by COVID. It means we can continue to adapt to and address community challenges through innovative and systems-based approaches, like bringing the SASH model to families. It means you are a part of the movement to address Vermont’s housing crisis and help family and friends gain access to healthy and stable homes. It means working together to support our communities’ vitality.

We started 35 years ago in the Clark, Canal Street neighborhood in Brattleboro. We’ve grown from there to create and retain permanently affordable homes across our two southeastern counties of Vermont. We’ve done this, and will continue to do this, with you. Thank you for contributing to this movement and to your community.

Ongoing support helps us engage communities during project development like this 27 mixed income, highly energy efficient and accessible apartment community in Bellows Falls village center.

Donations

Individual Donations

Business Sponsorships

Support Windham & Windsor Housing Trust

OUR STAFF BUILDING CONNECTIONS

OUR STAFF

BUILDING CONNECTIONS

Jennifer Anderson, SASH Wellness Nurse

Molly Bennett, SASH Coordinator

Edward Bordas, Director of Asset & Property Management

Elizabeth Bridgewater, Executive Director

Tara Brown, Lending Manager

Barbara Carey, SASH for All Wellness Nurse

Steven Casabona, Homeownership Specialist

Jerry Freeman, Repair Specialist

Katherine Freyenhagen, Leasing Agent

Sandra Garland, Finance Director

Alex Gero, Maintenance Technician

David Grobe, Repair Specialist

Timothy Herzig, Staff Accountant

Bill Hodgman, Facilities Manager

Philip Jones, Maintenance Technician

Martha Kerylow, Front Desk Coordinator

Lisa Kuneman, Associate Housing Developer

Marion Major, Outreach Coordinator

Paul Martorano, Multi-family Rental Improvement Coordinator

Codi Merlin, Maintenance Technician

Brady Merrigan, Assistant Property Manager

William Nickey, Human Resources Manager

Peter Paggi, Development Director

Jeremy Paquette, Homeownership Program Coordinator

Katy Peterson, Sash for All Coordinator

Susan Rousse, Compliance & Leasing Manager

Amanda Spaziano, Property Manager

Joyce St. Jean, Resident Services Manager

Travis Tarbox, Maintenance Technician

Robert Tarbox, Maintenance Technician

Bruce Whitney, Director of Homeownership

Katrina Willette, Accounting & Technology Specialist

Kayla Bernier-Wright, Homeownership Specialist

Chris Zappala, Maintenance Technician

OUR BOARD

Leadership Community

Resident Members

Assaduallah Akhlaqui, SECRETARY

Christina Lively

Ellen Snyder

Dora Urujeni

Naima Wade

Public Service Directors

Carol Buchdahl

Chuck Collins

Carmina Garciadealba

Cynthia Gubb

Leo Schiff

General Community Members

Victor Morrison, PRESIDENT

Margaret Clark, VICE PRESIDENT

Debbie Boyle, TREASURER

Denny Frehsee